www tax ny gov online star program

Provide the names and social security numbers for all owners of the property and their spouses. We changed the login link for Online Services.

The following security code is necessary to prevent unauthorized use of this web site.

. If your income is greater than 250 000 and less than or equal to 500000 you can register online for New York State STAR tax credit or by calling 518-457-2036. Enter the security code displayed below and then select Continue. You will need to.

Visit wwwtaxnygovonline and select Log in to access your account. You can Register for the STAR credit online. The following security code is necessary to prevent unauthorized use of this web site.

Below you can find a guide to frequently asked questions about the program. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance.

The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. If you are using a screen reading program.

We recommend you replace any bookmarks to this. If you will be 65 or older in the year which you apply and have had a STAR exemption on your property in 2015-16. Parts to the STAR property tax exemption Enhanced STAR and Basic STAR.

Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Answer a few questions about the income and residency of the owners and their spouses. STAR Check Delivery Schedule.

If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518-457-2036 from. The Village of Freeport has no role in administering this program. This State-financed exemption is authorized by Section 425 of the Real Property Tax Law.

STAR is New York States School Tax Relief Program that provides tax exemptions to. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. Enter the security code displayed below and then select Continue.

All New Yorkers who own or have life use and live in their. If you are using a screen reading program. Apply online Apply by mail show this list.

Provide the date you purchased your property and the name of the sellers. Home are eligible for the STAR exemption on their primary residence. The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

More information is available at wwwtaxnygovstar or by calling 518 457-2036.

The School Tax Relief Star Program Faq Ny State Senate

Queens Community Board 6 Home Facebook

Pin On Digital Marketing News Info

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Nyc Residential Property Tax Guide For Class 1 Properties

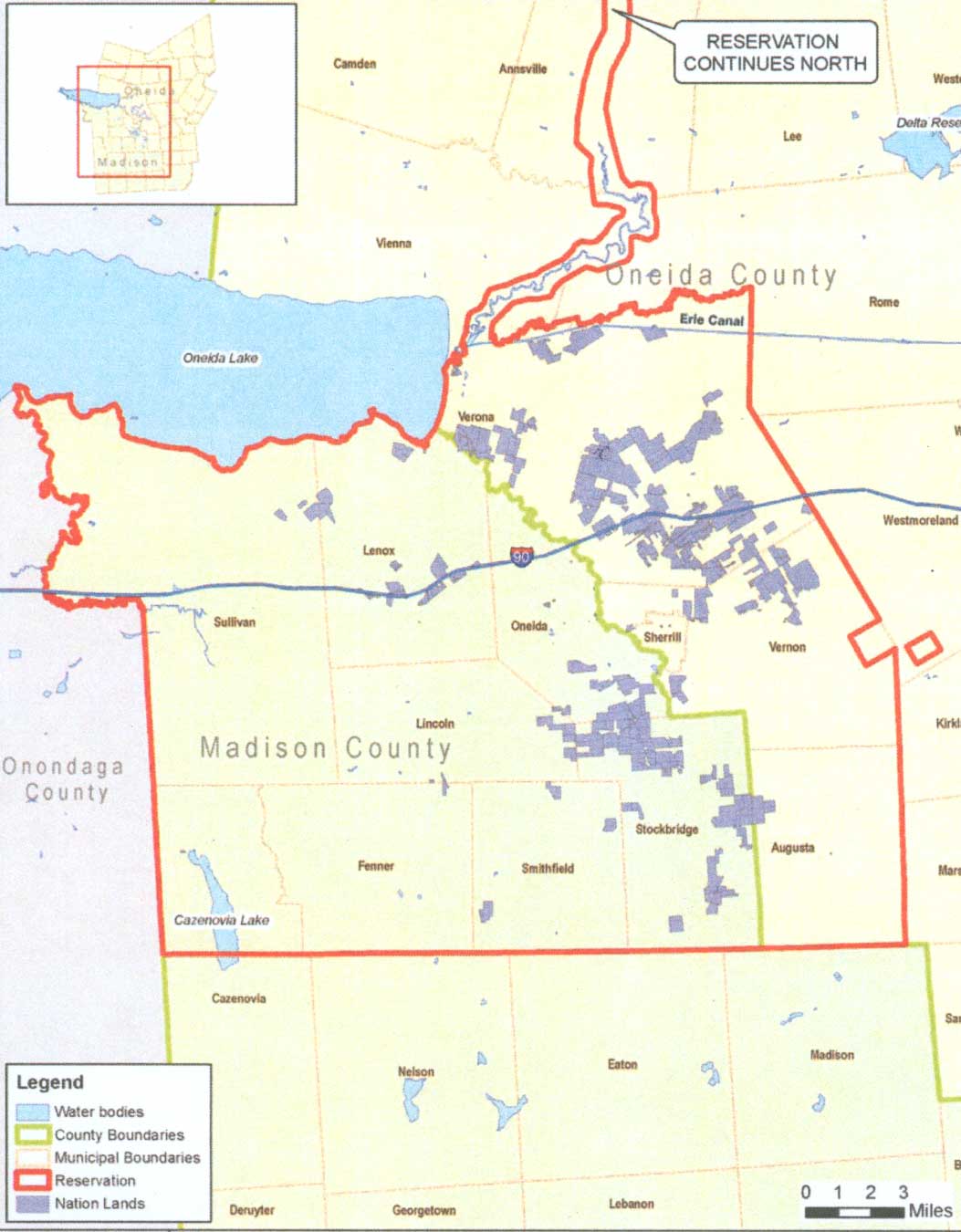

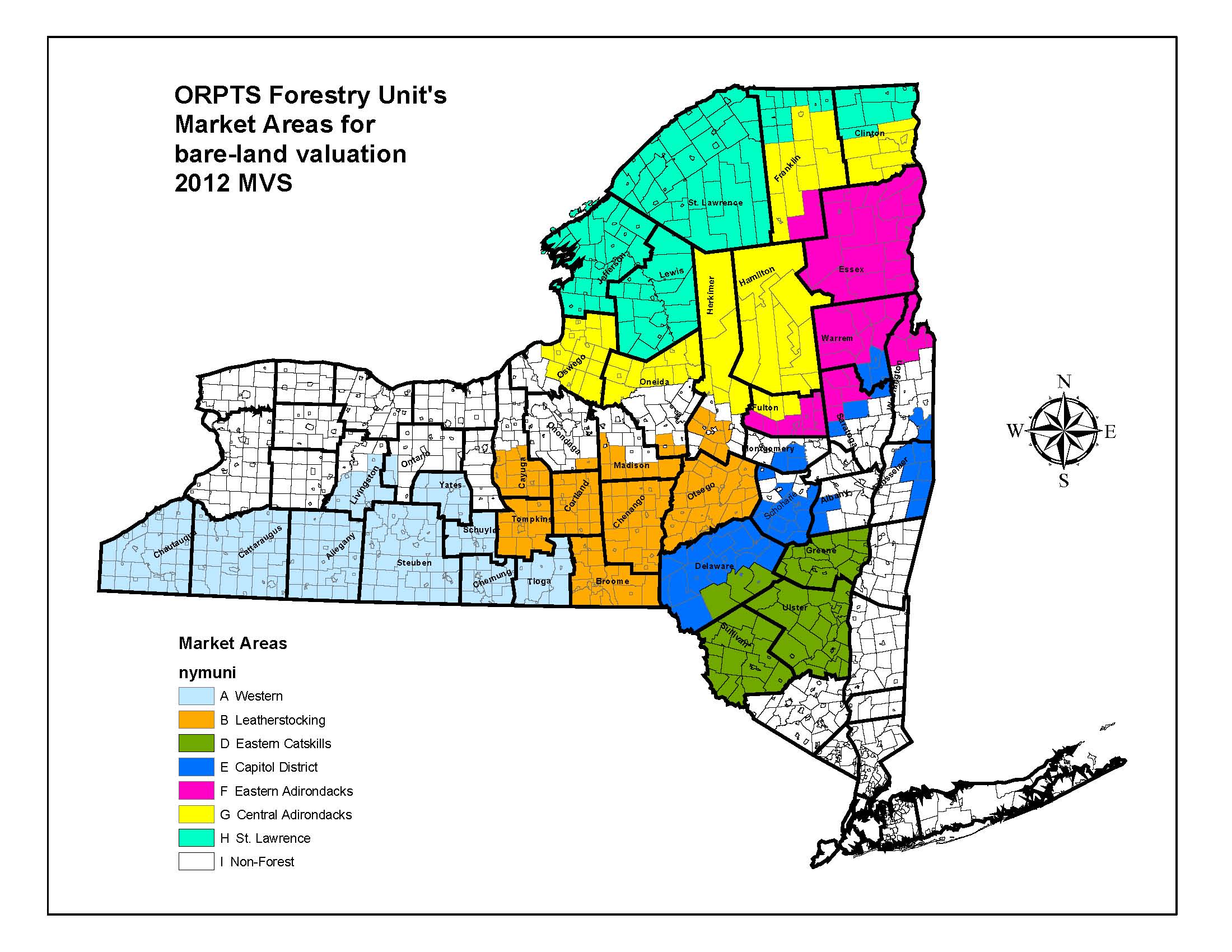

Forestry S Bare Land Valuation Map

Receiver Of Taxes Town Of Oyster Bay

Receiver Of Taxes Town Of Oyster Bay

States With Highest And Lowest Sales Tax Rates

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Pin On Best Of The Canadian Personal Finance Place

Smart Chart Six Ways To Tackle Sky High Inequality Billmoyers Com Economy Infographic Social Studies Worksheets Inequality