retroactive capital gains tax hike

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. In order to pay for the sweeping spending plan the president called for nearly doubling the capital gains tax rate to 396 from 20 for Americans earning more than 1.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from.

. The capital-gains tax rate increase from 20 to 396 would be retroactive to April 2021. President Biden really is a class warrior. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

This may be why the White House is seeking an April 2021 effective date for. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year. However qualified small business stock the darling of.

The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. In the months since President Biden announced his tax reform proposal that included a tax hike on income recognized from capital gains investors have been keeping a.

You can get up to 10M tax free that way a zero tax. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions.

Biden wants to raise the tax rate on capital gains from the present 238 percent to a staggering 434 percent on households that make an annual income of more than 1 million. Advisors look for ways to lessen Bidens proposed retroactive capital gains tax hike President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax. President Bidens proposal to increase the capital gains tax has generated tremendous discussion.

Advisers blast Bidens retroactive cap gains hike. According to some Washington policy experts the Presidents tax plan will likely pass but in a modified version with a smaller capital gains tax increase the initial proposal. A Retroactive Capital Gains Tax Increase.

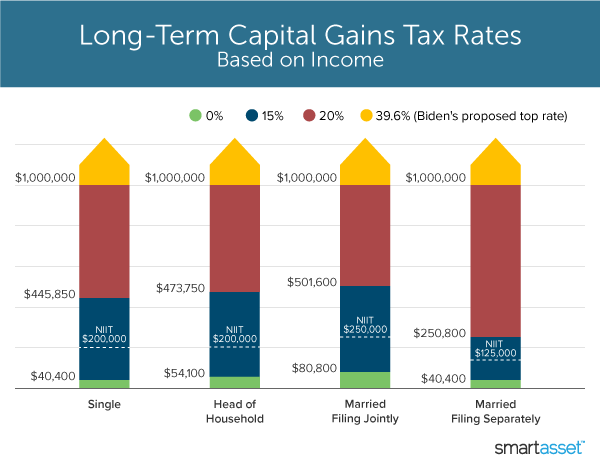

The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38. KEY POINTS The Biden administration would raise capital gains to 408 on high. Retroactive Capital Gains Tax Hike.

This is a MAJOR change and may not be the only retroactive change listed in the. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. Retroactively for income over 1M capital gain tax is now 434.

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Taxes Archives Page 2 Of 3 Cd Wealth Management

Can Congress Really Increase Taxes Retroactively

Crystal Ball Gazing To The Past Article By Pearson Co

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

How The Potential Tax Changes Can Impact Your Investments Chase Com

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Will You Be Paying Higher Taxes On Your Capital Gains Elderado Financial

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Biden S Capital Gains Plan Changes May Affect Your Current And Planned Investments

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management